Learn

Checking Accounts

Comparing Checking Accounts

When deciding which bank and checking account is right for you, it is important to consider several different factors:

- Location – bank offices, hours of operation, availability of ATMs

- Fees – monthly fees, paper statement fees, inactivity fees, minimum balance charge, ATM fees, overdraft fees

- Interest – rate earned on money in account, compounding method

- Restrictions – minimum balance, holding period for deposited checks

- Special Features – apps, overdraft protection, online banking, discounts or free accounts for students

Opening a Checking Account

When you open a checking account, you will fill out paperwork.

Most notably, you will fill out a signature authorization card. This tells the bank which signatures are authorized to makes changes to the account.

The bank can use the card to compare future signatures that are signed on checks associated with the account.

Making a Deposit

After you set up your checking account, you will need to make a deposit. You can deposit cash or checks into the account.

You must fill out a deposit slip to let the bank know which account the money is going into and to keep a record of the deposit.

You will receive deposit slips with your account number printed on them, but you can also fill out a blank deposit slip at the bank.

Let's look at an example deposit slip.

Sample Deposit Slip

Open Deposit Slip in a new tab

Note: The presentation may take a moment to load.

Endorsing a Check

When cashing or depositing a check, you need to endorse it. This means, you will turn it over and sign it. There are 3 different types of endorsements:

Blank Endorsement – if you just sign you name, anyone can cash the check

Restrictive Endorsement – you may write "for deposit only" with your account number and your signature. This is more secure than a blank endorsement.

Special Endorsement- you may write "pay to the order of Jane Smith" or anyone else you would like to transfer the check to. You will need your signature for all endorsements.

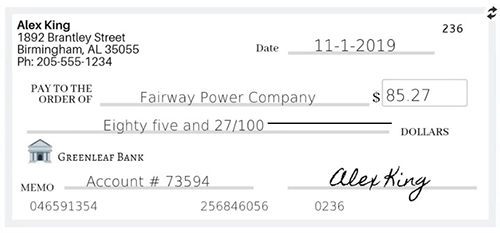

Writing a Check

Open Writing a Check in a new tab

Note: The presentation may take a moment to load.

To avoid potential fraud, you can draw a line from the amount in words down to the word "DOLLARS" on the line under PAY TO THE ORDER OF (see the example below). It is optional, but it is not required.

Maintaining Your Check Register

A check register is a booklet that comes with your checks. It provides a place to keep a record of every transaction that affects your account balance. Transactions that will affect your account balance are:

- Writing a check

- Withdrawing money from the ATM

- Using your debit card

- Incurring a bank fee

- Depositing money into your account

- Interest earned on your account

Let's look at a sample check register.

Sample Check Register

At the beginning of the month, John's checking account balance is $495.84. If John writes a check at B's Clothing Store, it would be recorded as follows:

| Check No: | Date | Description | Transaction Amount | Deposit Amount | Balance | ||||

|---|---|---|---|---|---|---|---|---|---|

| Beginning Balance | 495 | 84 | |||||||

| 160 | 6/4 | B's Clothing Store | 56 | 54 | 439 | 30 | |||

On June 7th, John goes to the ATM and withdraws $40. That would be recorded in the check register as follows:

| Check No: | Date | Description | Transaction Amount | Deposit Amount | Balance | ||||

|---|---|---|---|---|---|---|---|---|---|

| Beginning Balance | 495 | 84 | |||||||

| 160 | 6/4 | B's Clothing Store | 56 | 54 | 439 | 30 | |||

| ATM | 6/7 | Withdrawal | 40 | 00 | 399 | 30 | |||

On June 15th, John gets paid. His paycheck is direct deposited into his account and increases his balance to $869.05. Notice deposits go in the deposit column.

| Check No: | Date | Description | Transaction Amount | Deposit Amount | Balance | ||||

|---|---|---|---|---|---|---|---|---|---|

| Beginning Balance | 495 | 84 | |||||||

| 160 | 6/4 | B's Clothing Store | 56 | 54 | 439 | 30 | |||

| ATM | 6/7 | Withdrawal | 40 | 00 | 399 | 30 | |||

| DEP | 6/15 | Paycheck | 469 | 75 | 869 | 05 | |||

On June 18th, John uses his debit card to purchase gas. That would be recorded as follows:

| Check No: | Date | Description | Transaction Amount | Deposit Amount | Balance | ||||

|---|---|---|---|---|---|---|---|---|---|

| Beginning Balance | 495 | 84 | |||||||

| 160 | 6/4 | B's Clothing Store | 56 | 54 | 439 | 30 | |||

| ATM | 6/7 | Withdrawal | 40 | 00 | 399 | 30 | |||

| DEP | 6/15 | Paycheck | 469 | 75 | 869 | 05 | |||

| Debit | 6/18 | Gas Station | 29 | 65 | 839 | 40 | |||