Learn

- Federalism's Impact

- Structure

- Services

- Federal vs. State Money

- Federal Funding

- Federal Regulations

- Revenue Sharing

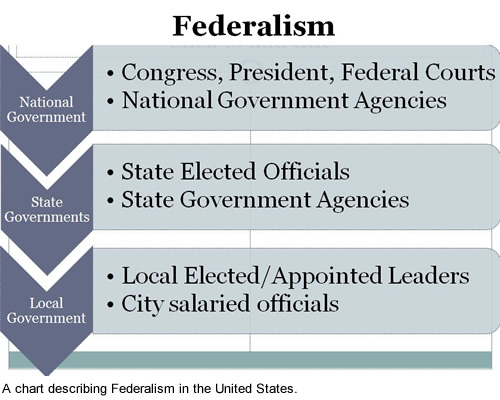

In order to understand how and why state and local governments work, you must understand that a federal system distributes power from a central branch to smaller and localized branches usually based on power and scale. Each level of government deals with issues that are appropriate to its size. For example, occasionally state and local governments face issues that are too big to be handled without the assistance of the federal government like Hurricane Katrina.

The President, Congress, and U.S. Supreme Court create and approve new laws that are then delegated down to national government agencies and/or state governments. From this level, power is then distributed again to county and city levels.

State Government Structure

The structure and function of state government is very similar to the national government with three branches of government, executive, legislative, and judicial branches. The three branches at the state level interact like those at federal level.

On the state level the chief executive is the governor. The second in command varies according to state constitutions. Alabama has a governor, lieutenant governor, a bicameral legislative branch and an elected executive cabinet. The cabinet has a secretary of state, attorney general and state treasurer to name a few offices.

Local Government Structure

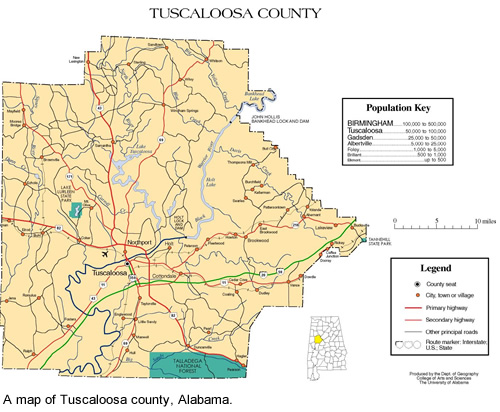

The next unit of government below the state is a county. A county is specific territory within a state and is created by the state. A county has set boundaries and its own administration. Local governments get their power from the state government.

A town is territory within a county with set boundaries and often a charter with the state. Many cities and towns are incorporated into municipalities. Some states may use different terms instead of cities or towns for example village, township, or borough. If a city/town is incorporated, they are able to function similar to a business and may sue or get sued like a corporation. Most states require a set population before incorporation, but it varies by each state's constitution. In contrast to a county being created by the state, a city is often created by the residents to get public services like city water.

Organization of Local Government

There are three general ways local governments are organized:

Mayoral System, the residents elect a mayor or executive and board members to serve on the city council or local legislature to execute the laws and fulfill the will of the people.

Commission System, the residents elect a group of people to serve on the commission, also called a board. The commission or board members lead different departments and set policies.

Council-Manager System, the residents elect a city council which is responsible for appointing a city manager to serve as the chief executive. The mayor leads the city council in the council-manager system.

State Constitutions and City Charters

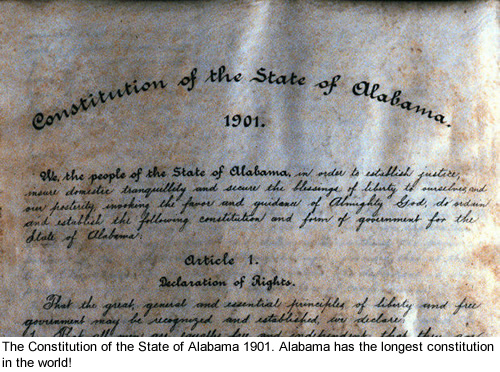

Every state in the United States has a constitution, which outlines the basic principles, functions, structure, and powers of government. A state constitution must conform to the U.S. Constitution.

A charter contains the basic laws, structure, and boundaries of a city and it must conform to the state constitution. A city may expand their boundaries through annexation. A large city is called a metropolis.

Read "State and Local Governments" to learn more about the structure and types of local governments.

Services of State Governments

Public services refer to a broad variety of programs state citizens enjoy. Examples include: schools, parks, roads and the list goes on. One of the biggest services is maintaining the state's infrastructure or support structures like transportation, communication, and power systems. The highways are maintained and regulated by the state governments. States are also responsible for licensing drivers. Because infrastructure like highways can be so expensive, the federal government provides funds for many of those projects.

Explore ALDOT to learn more about transportation services in Alabama.

Services of Local Governments

The services provided by the cities and counties are actually decided by the state. Local governments have to follow state and federal laws when they provide these services. Local governments are closer to the citizens; therefore, it is easier for them to provide services directly to the people. Local services include: schools, libraries, recreation facilities, water treatment, and garbage collection.

Explore Alabama Counties to learn more about the geography of each county.

Providing Public Safety

One of the most important services that state and local governments provide is public safety for citizens. These services include state and local police, fire safety, child protective services, and hospitals. States also protect citizens by regulating, or providing rules for everything from certification for health professionals, builders, and barbers to enforcing building codes for construction. In addition, inspections are conducted on food, restaurants, and gas pumps.

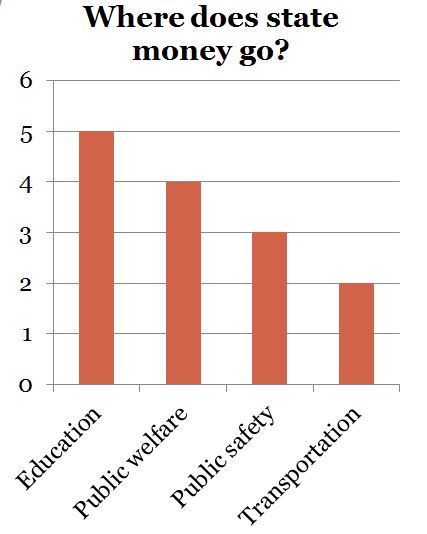

Public services provided by state and local governments can be extremely expensive. State and local governments get the money to provide public services from two main sources, tax dollars from the citizens and funding from the federal government. The sharing of revenue by the national government with the states is a primary reason for the changes that have occurred in power shared between the national and state governments.

How States Pay the Bills

If the state cannot get federal dollars, the revenue must be raised at the state/local level or it must forgo the programs. States use several different types of taxes to raise revenue in order to fund state agencies, programs, and entitlements. The different types of taxes include:

Progressive tax

Proportional tax

Regressive tax

Sales tax

Income tax

Property tax

Public safety is a fundamental quality that all citizens require. Citizens will gladly pay taxes to ensure their safety.

State Taxes

A sales tax is the most common and popular form of taxation. A fixed percentage rate is charged for purchased items. In other words, an 8% rate equals eight cents for every dollar. For example, when you purchase a soft drink from a convenience store, you will most likely pay a sales tax. This tax is applied to all items purchased by consumers. A portion of the tax will go to the state and often a portion will go to the city.

Many object to states relying on sales tax because it is a regressive tax.

An income tax is the most popular form of a progressive tax.

A property tax is the most popular form of a proportional tax.

Read "Financing State and Local Government" to learn more about revenue for state and local governments.

Federal Grants

Fiscal federalism involves the national government offering money to the states in the form of grants to promote public welfare, environmental standards, and educational improvements.

The most common federal grant is a categorical grant which is distributed to state or local governments by Congress for a set purpose. For example, categorical grants may have been offered to communities throughout Alabama after the disastrous tornadoes in April 2011.

Block grants are also distributed by Congress to state and local governments; however, they may be used for general purposes. States have more flexibility on how the money may be spent; therefore, Congress has less control and is reluctant to use block grants.

Funding for Additional Services

In many cases, national government programs do not go far enough to satisfy the needs of the states. Many states offer supplemental programs to take care of the citizens.

Alabama gets a block grant to provide Temporary Assistance to Needy Families (TANF). The TANF will cover a citizen for up to five years. If the grant does not provide enough money, the state must make up the difference.

Alabama also has a health care program for all minor children called All Kids. These types of programs are public welfare programs. The taxes of citizens take care of those that may not be able to help themselves. Other examples include W.I.C. programs, school immunization programs, and free birth control to name a few.

National government power has expanded due to the offer and influence of grants to the states. Sometimes federal money comes with strings attached due to government regulations placed on state and local governments.

In other words, the national government may attach federal mandates to grant money that require states to implement certain policies in order to receive the money. For example, in order to receive federal highway funds, the federal government will require a seatbelt law. States have the option to refuse the money, but it is less complicated and cheaper to pass the law.

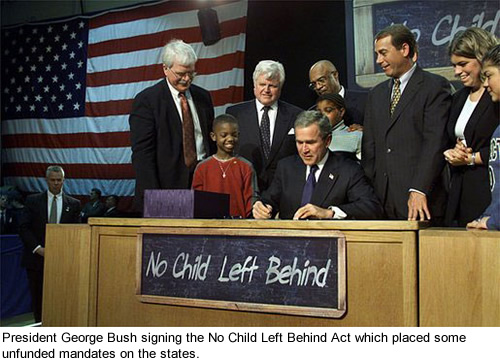

The federal government can also pass an unfunded mandate that may place regulations on states without the guarantee of federal dollars. The No Child Left Behind Act is a modern example of states trying to fund federal programs with state funds.

The federal government started a program of revenue sharing during the Nixon administration that shared tax revenue with the states. States used the revenue to fund state projects. The federal government stopped this program in 1986.

The federal government shared revenue with state governments and as a result was able to impose some policy mandates on the states. Watch Federalism: U.S. vs. the States (27:41) a video from Annenberg Learning's Democracy in America series.