Learn

Debits must equal Credits

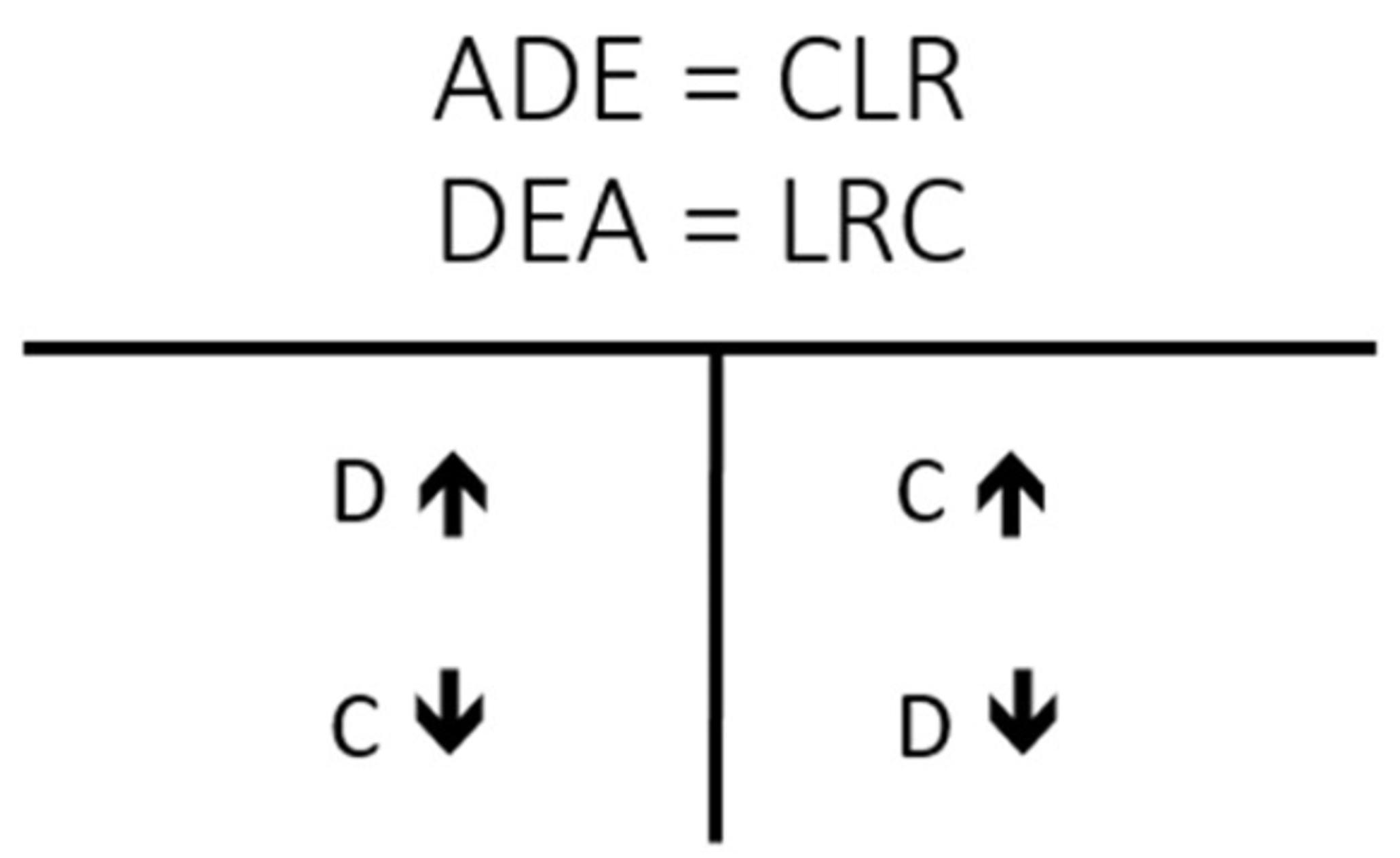

You have been told that for every business transaction, at least two accounts will be affected and that the Debits must equal Credits. When a business transaction occurs, think about what is happening. Using the T-account diagram let's look at a few business transactions:

| ADE (Asset, Drawing, Expense) = CLR (Capital, Liability, Revenue) | |

Debits Increase |

Credits Increase |

Business Transaction 1

A business makes a Sale for $50.00 and receives Cash from the customer.

- What two business accounts have been affected?

- Sales and Cash – Sales because the business made a sale and Cash because the customer paid.

- What type of account is Cash?

- Cash is an item the company owns.

- Do you have more money in the Cash account after this transaction?

- Yes, you do, will you Debit or Credit the Cash?

- What type of account is Sales?

- Revenue – Sales is how the business earns money.

- Do you have more in the Sales account after this transaction?

- Yes, you do, will you Debit or Credit the Sales?

- Credit

- Yes, you do, will you Debit or Credit the Sales?

Now for the other half of the business transaction.

Business Transaction 2

A business purchases equipment and pays cash for the equipment.

- What two business accounts have been affected?

- Equipment and Cash – Equipment because the business purchased it and Cash because the business paid.

- What type of account is Equipment?

- Asset – Equipment is an item the company owns.

- Do you have more in the Equipment account after this transaction?

- Yes, you do, will you Debit or Credit the Equipment account?

- Debit

- Yes, you do, will you Debit or Credit the Equipment account?

- What type of account is Cash?

- Asset - Cash is an item the company owns.

- Do you have more in the Cash account after this transaction?

- No, you paid for the equipment, will you Debit or Credit Cash?

- Credit

- No, you paid for the equipment, will you Debit or Credit Cash?

Now for the other half of the business transaction.

Business Transaction 3

A business purchases supplies and charges it to their account – they do not pay now; they will pay later.

- What two business accounts have been affected?

- Supplies and Accounts Payable – Supplies because the business purchased it and Accounts Payable because the business owes for the supplies.

- What type of account is Supplies?

- Asset – Equipment is an item the company owns.

- Do you have more in the Supplies account after this transaction?

- Yes, you do, will you Debit or Credit the Equipment account?

- Debit

- Yes, you do, will you Debit or Credit the Equipment account?

- What type of account is Accounts Payable?

- Liability – Accounts Payable is an account the company owes.

- Does the company owe more after this transaction?

- Yes, the company owes more, how will the company record this increase in liabilities, will they Debit or Credit Cash?

- Credit

- Yes, the company owes more, how will the company record this increase in liabilities, will they Debit or Credit Cash?

Now for the other half of the business transaction.

Business Transaction 4

The owner, John Smith, makes a Cash investment into the business.

- What two business accounts have been affected?

- Cash and John Smith, Capital – Cash because the business received money and John Smith, Capital, because the owner made an investment.

- What type of account is Cash?

- Asset – Equipment is an item the company owns.

- Do you have more Cash after this transaction?

- Yes, you do, will you Debit or Credit the Cash account?

- Debit

- Yes, you do, will you Debit or Credit the Cash account?

- What type of account is John Smith, Capital?

- Capital – Capital is the owner's investment in the company.

- Do you have more in John Smith, Capital after this transaction?

- Yes, the owner has more invested in the business, will you Debit or Credit Cash?

- Credit

- Yes, the owner has more invested in the business, will you Debit or Credit Cash?

Now for the other half of the business transaction.

Business Transaction 5

The business pays Rent Expense.

- What two business accounts have been affected?

- Rent Expense and Cash – Rent Expense, because this is something the business must pay when due and it is required to generate revenue. Cash because the business paid.

- What type of account is Rent Expense?

- Expense – Rent Expense is part of the cost of operating the business – expenses must be paid so the business can earn revenue.

- Do you have more money in the Rent Expense after this transaction?

- Yes, you have more money that has been paid for Rent Expense. Remember, you will keep up with how much Rent Expense you pay for the year. Will you Debit or Credit the Rent Expense account?

- Debit

- Yes, you have more money that has been paid for Rent Expense. Remember, you will keep up with how much Rent Expense you pay for the year. Will you Debit or Credit the Rent Expense account?

- What type of account is Cash?

- Asset – Cash is an item the company owns.

- Do you have more in the Cash account after this transaction?

- No, you paid for the equipment, will you Debit or Credit Cash?

- Credit

- No, you paid for the equipment, will you Debit or Credit Cash?

Now for the other half of the business transaction.

Business Transaction 6

The owner, John Smith, withdrawals $500 from the business.

- What two business accounts have been affected?

- John Smith, Drawing and Cash – John Smith, Drawing, because the owner has the right to withdrawal money from the business. All withdrawals are tracked in the "Drawing" account. Cash is also affected, because the owner withdrew Cash.

- What type of account is John Smith, Drawing?

- Expense – John Smith, Drawing is a Drawing Account – it is anytime the owner makes a withdrawal.

- Do you have more money in John Smith, Drawing account after this transaction?

- Yes, you have more money. The Drawing account will keep track of how much money the owner has withdrawn for the year. Will you Debit or Credit John Smith, Drawing account?

- Debit

- Yes, you have more money. The Drawing account will keep track of how much money the owner has withdrawn for the year. Will you Debit or Credit John Smith, Drawing account?

- What type of account is Cash?

- Asset – Cash is an item the company owns.

- Do you have more in the Cash account after this transaction?

- No, the owner withdrew Cash, will you Debit or Credit Cash?

- Credit

- No, the owner withdrew Cash, will you Debit or Credit Cash?

Now for the other half of the business transaction.